OCOE-Financial-Model

The financial model in Openwind is relatively simple, as its only purpose is to compare lifetime costs and revenues of variants of a single project design. The entire wind farm is built instantly at time zero and immediately commences electricity generation at full capacity according to the energy capture calculation. The result of the energy capture is used as the basis of the annual revenue in the financial model.

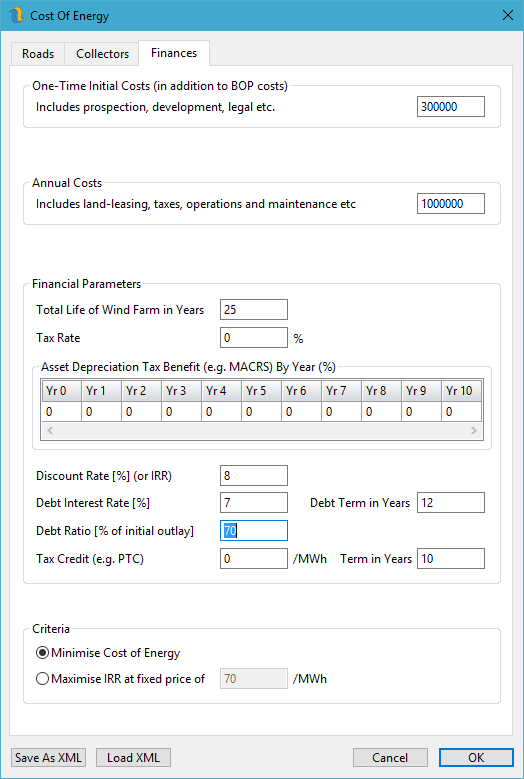

Figure 160: Simplified Financial Model Settings

The inputs to the simplified financial model can be seen in figure 160.

One-Time Initial Costs - these are any and all one-time upfront costs not included elsewhere.

Annual Costs - these are any and all annually recurring costs which are not included elsewhere.

Total Life of Wind Farm in Years - the project life over which costs and revenues are to be offset.

Tax Rate – this is the rate of taxation applied to the wind farm revenue minus the loan interest payments.

Asset Depreciation Tax Benefit (e.g. MACRS in the US) – this benefit amounts to the initial capital cost multiplied by the tax rate multiplied by the depreciation rate for any given year. For wind projects, asset depreciation normally takes place over 10 years or less.

Discount Rate - see a financial/economic text for a full explanation of this. In short, it is the rate at which the present value of future expenses or revenues decreases with time. For most investments, the discount rate is determined by the sources of financing, whether debt or equity or some mix of the two, and the perceived risk of the investment. It is a key input in the NPV.

Debt terms - the mix of equity and debt and the terms of any loan can influence the NPV and are therefore required as inputs:

- Debt Interest Rate - the annual percentage rate at which interest is charged on any outstanding loan amount. This interest amount is subtracted from the project revenue on an annual basis in addition to the fixed loan repayment rather than being rolled into the outstanding debt as would be usual in a mortgage.

- Debt term in years - the period over which the loan is repaid in equal amounts.

- Debt Ratio - the percentage of the amount of the upfront capital costs that are to take the form of a loan.

Tax Credit (e.g. PTC) – this amount is simply added to the price per MWh for the term of the credit.

Minimise Cost of Energy - this option tells the optimiser to drive down the price of energy based on a NPV of zero.

Maximise IRR at fixed price of – this option fixes the price of energy and tells the optimiser to attempt to drive up the internal rate of return (IRR).

Once the appropriate cost parameters are entered (below), the cost of energy is calculated by running the financial model for the life of the project and then iterating the cost of energy such that the net present value of the project is zero. The internal rate of return is calculated using a very similar financial model.